My Role: UX Researcher, Project Manager

Dates: January - March 2023

Deliverables: Research Guide, User Survey, Interview Script

Team: Carrie Webber, Jayda C., Chelsey K., Lyric F.

Introduction

What started as a design assignment at Flatiron School became an ongoing passion project for my classmates and I after graduation. As a team, we continued collaborating and conducted extensive UX research to solve for a real-world problem near and dear to our hearts: low financial literacy rates for women and girls.

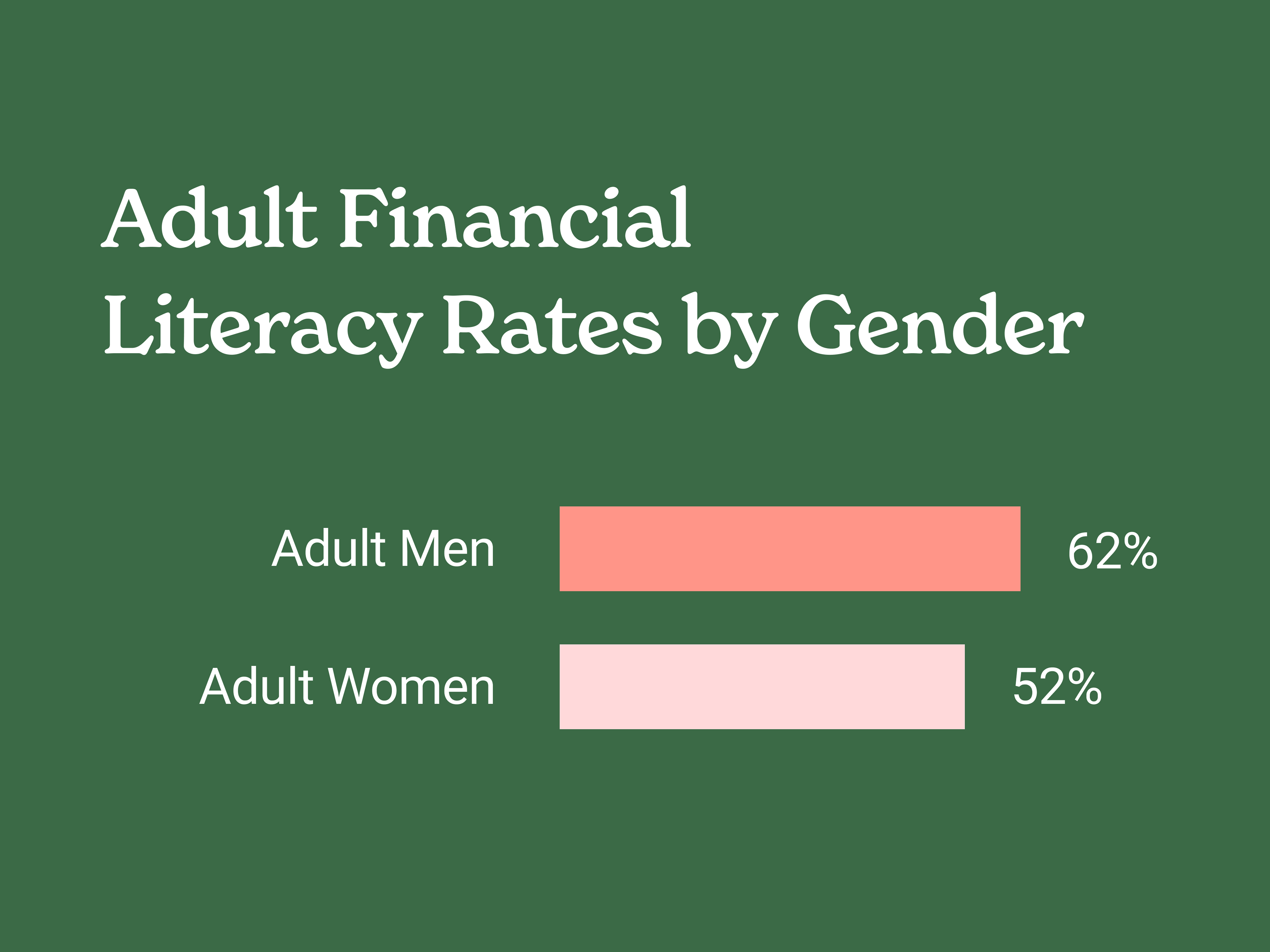

Source: MILKEN Institute, Financial Literacy in the United States, 2021

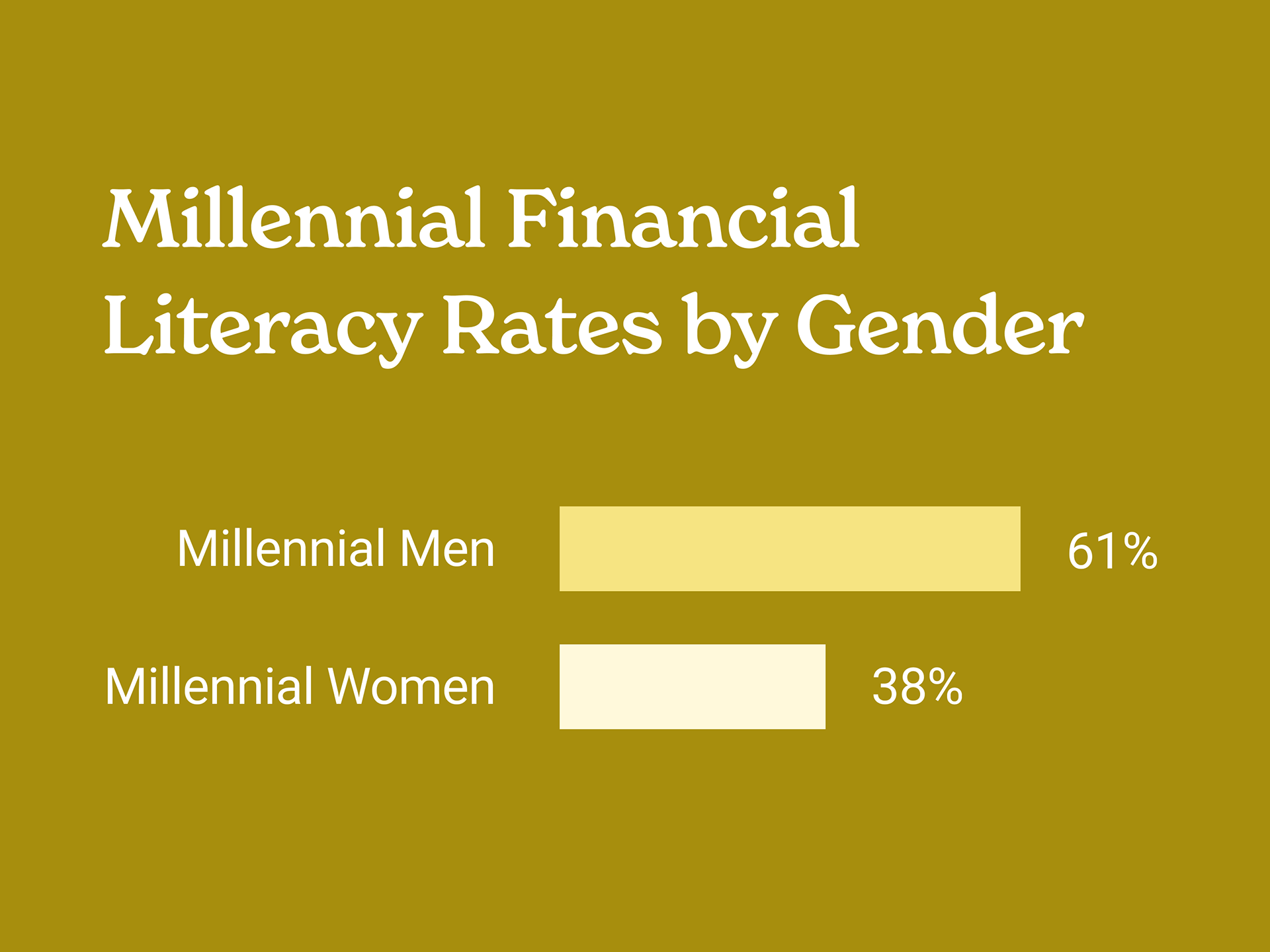

Source: GFLEC Insights Report, May 2019

Background

Financial literacy is important for everyone, especially for women. Women tend to live longer, have weaker earning power, and experience larger gaps in employment due to caregiving responsibilities. However, studies have shown that women test disproportionately low on financial literacy knowledge and they lack confidence in making financial decisions. As seen above, this trend is also evident among younger women born between 1981-96.

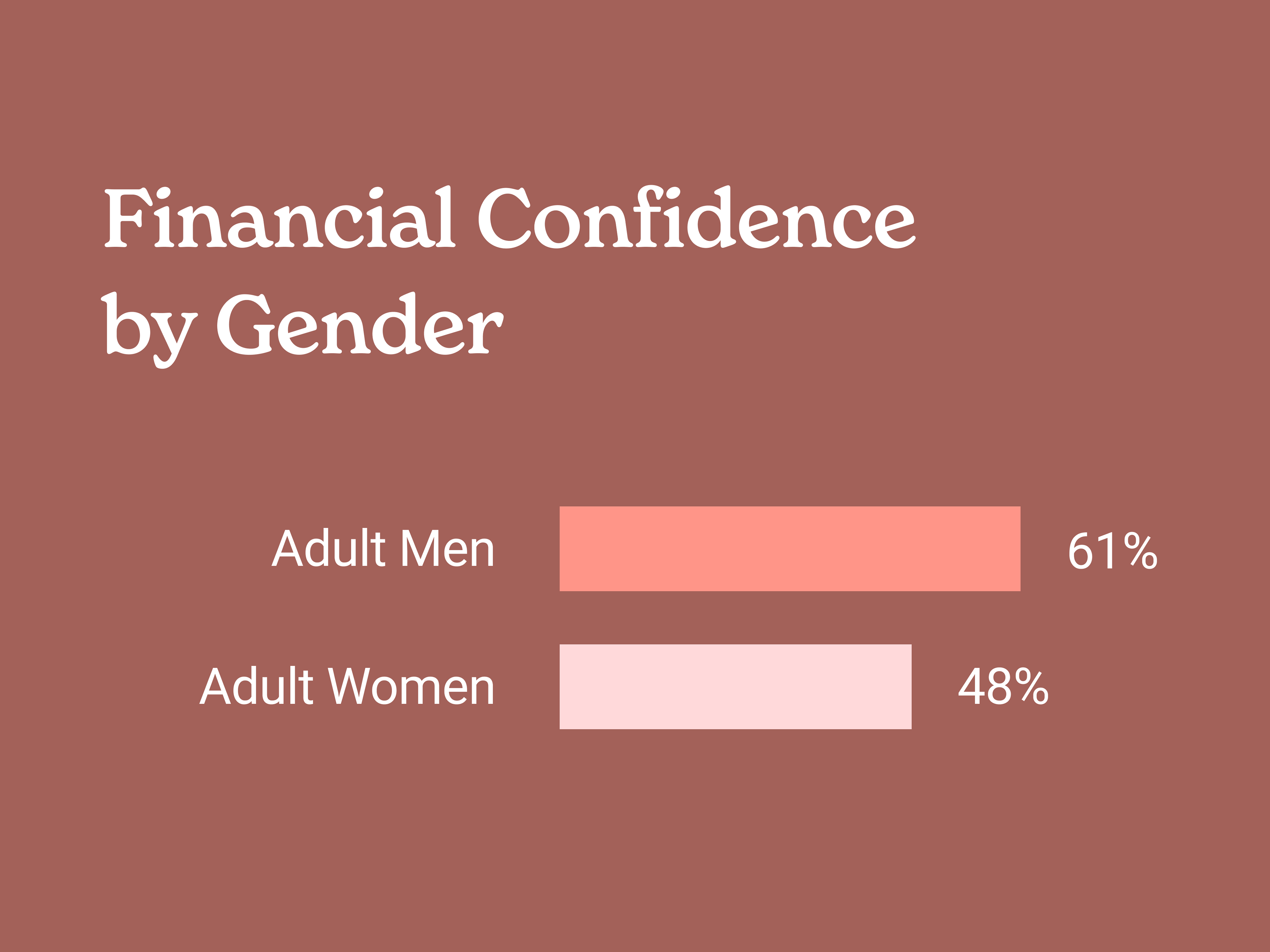

Source: U.S. Bank’s 2020 Women and Wealth Insights Study

Business Goals

Our primary goal was to create a web landing page that would convert moms into paying customers of an online financial literacy program for their daughters. The second goal was to understand what would be the most effective way to help moms teach their daughters early money habits.

Source: Survey by GiftCards.com: Adolescent Income and Financial Literacy

Source: National Literacy Trust, 2022

The Need

Research shows that parents tend to teach their daughters differently than their sons when it comes to personal finance. Girls are often taught fiscal restraint, while boys are taught more about building wealth. This can result in a gender gap in financial confidence, leading women to avoid healthy financial risks later in life. This fear of risk-taking can be detrimental when it comes to important life decisions, such as planning for retirement, investing, negotiating a pay raise, or taking out a home loan.

However, research also shows that introducing children to financial concepts at an early age can positively impact their financial futures. As a result, this product aims to empower moms to become financial role models for their children, particularly their daughters who often look up to them, and help close the gender gap in financial confidence.

Research Goals

To support the goals of the business, we set out to understand the following:

1. How confident are moms in teaching their daughters about money?

2. What are they already doing?

3. How often and what topics do they discuss?

4. What are their top pain points?

5. What would motivate them to enroll their daughter?

Methods

To answer these questions, the following methods were used:

Discovery Research: We conducted exploratory research to gain a deep understanding of the problem space and the target audience. This involved conducting a literature review of existing research on financial literacy and gender and a competitive analysis.

Survey: An online survey was conducted to gather initial data from 22 moms who have daughters ages 3-12. The survey consisted of 10 questions utilizing a likert scale and ranking exercises. This allowed us to understand how moms in 2023 teach their daughters about personal finance, their pain points, and what would motivate them to enroll their daughters in an online financial literacy program.

Interviews: We conducted 5 user interviews with moms who fit the demographics of our target audience. These were held remotely via Google Meets and audio was recorded with permission. Each session was 30 minutes long and included a short briefing and an interview. The goal was to gain a deeper understanding of their attitudes, beliefs, and experiences regarding money and what would make them feel more confident to enroll their daughter in an online financial literacy program.

Expected Outcomes

When we set out to hypothesize on some of the answers to our research questions, we went wide and made some educated guesses, or assumptions, about their experiences and behaviors:

1. How confident are moms in teaching their daughters about money?

Moms may not feel confident teaching their daughters about money due to shame or embarrassment about their own handling of money.

2. What are they already doing?

Moms may teach their daughters about money sporadically, only as the topic comes up in daily life.

3. How often and what topics do they discuss?

Conversations about money for girls aged 3-12 may not happen with much planning or intention, and may only cover simple topics like spending and saving.

4. What are their top pain points?

Moms may be too busy to regularly talk about money with their daughters and may assume their daughters are learning about personal finance in school.

5. What would motivate them to enroll their daughter in a digital program?

To motivate moms to enroll their daughters in a digital program, the program should start with familiar money lessons, be simple to use, and focus on internet safety for daughters.

Results

1. How confident are moms in teaching their daughters about money?

Our survey results indicated that a majority of moms felt moderately confident about discussing money and finance with their daughters. In fact, when given a range of options to describe their feelings toward the idea of teaching their daughters about money, (from unsure, reluctant, embarrassed, excited, motivated, and confident) 50% of moms chose "motivated" and 31.8% chose "confident." These findings were surprising, as they contradicted our initial hypothesis. It showed that moms are not only willing but also confident to have conversations with their daughters about money.

2. What are they already doing?

Our findings revealed that most moms react to money suddenly becoming an option for their daughters and do not spend much time on intentional planning. Instead, they seem to react to the situation and feel the need to do something about it. While some moms use books and technology as resources, many still rely on the way they were taught about money by their parents. Furthermore, their daughters are much more interested in using technology than they are. When it comes to teaching a new topic, moms are reluctant to use tech.

3. How often and what topics do they discuss?

More than 54% of moms from our survey reported that they "sometimes" discuss financial topics with their daughter and 27% reported that they do it "often." Saving, spending, earning, and managing money were the most frequent topics, while maintaining a budget, investing, and debt were rarely discussed.

4. What are their top pain points?

When we talked with moms, we heard a variety of answers, from a lack of knowing where to start, to not having a strong base to work from, considering their parents were also not financially savvy. Here is a sample of what we heard:

Not knowing where to start:

"I just don’t know what to do and where to start. I don’t know at what age we should be doing what or how much control she should have."

"The hardest part is not knowing where to start. I want a guideline for how to move through the process, whether it’s starting with a little bit of allowance and figuring out where to put it and why to put it there."

Guilt, shame, or embarrassment:

"I wish I would’ve made better financial decisions myself so I could be a better example for her."

"I wish there was a plug-and-play for this, something with endless resources. But it starts with the parents."

"Teaching children about these things is most affective when taught in little bits at a time. I know I struggle to be consistent about it."

Lack of support:

"Raising a child is so hard in the first place. The impact that economics has on that is severe... We need more support in general, especially for things that are more male-dominated. Because we’re out here doing it too."

"This topic never crossed my mind in the first place. Maybe that’s part of the problem. No one’s really talking about it."

No money role model:

"I don't have the knowledge from my parents to teach my own daughter about finances. I feel lost about teaching finances."

“I wished that someone sat me down and told me how to do stuff and I would’ve made better decisions.”

"I wish I would’ve made better financial decisions myself so I could be a better example for her."

"My parents were terrible money managers and never talked with me on this. I am not great at money management and I would like her to feel more informed."

5. What would motivate them to enroll their daughter in a digital program?

Most mothers were motivated by the potential to prepare their daughter for financial independence so that one day, she could meet her own basic needs on her own. Most moms reported thinking their daughters were too young to understand big money concepts, however, our discovery research indicated that the earlier moms start talking with their daughters about money at age-appropriate level, the better prepared they are.

Design Recommendations

In conclusion, our research has lead us to recommending the following UX design elements for each of the organization's business goals:

Business Goal #1: Web landing page that will convert moms into paying customers of an online financial literacy program for their daughters.

Business Goal #2: Understand what would be the most effective way to help moms teach their daughters early money habits.

Audience: My competitive analysis showed that most organizations doing similar work are serving only older girls, ages 13-18. This product has an opportunity to focus on an audience of mothers of younger girls, ages 3-13, which will give the organization a unique value proposition. Research shows that girls from this age range can learn developmentally-appropriate money lessons from their first role model, their mother.

Content: I recommend focusing the web landing page content on this targeted audience and highlight the idea of a their daughter's future financial independence as a main motivation. Use imagery of young girls with their moms doing regular, everyday tasks and discussing financial decisions together.

User Interface: I heard moms of daughters ages 3-13 say that money lessons are taught "on the go" during everyday activities, like grocery shopping or receiving gifts. I also learned that moms struggled with knowing where to start.

Therefore, I suggest the product focuses on the mother as the primary customer. After she creates an account with the organization, consider UI features such as simple push notifications or texts that she can receive with suggestions for educational content, such as the developmental stage of her daughter and what she is or is not able to understand about money.

The product should generate ideas for ways the mothers can build early money habits with her daughter that are age-appropriate. This simple interaction will not overwhelm the user as she does her activities and it will guide her by suggesting fun, engaging activities that she can do with her daughter.

User Journey: The first step on the customer journey map would include the mother signing up for an account to enroll her daughter in an online financial literacy program. She would complete her profile and enter non-invasive information about her daughter, such as her age and interests. She would then opt in to receiving push notifications or texts. The texts would include links to full length resources and information regarding activities for financial literacy education.